Solana Is to Stablecoins What iOS Was to Mobile

As stablecoins explode in volume, Solana is quietly becoming the platform where stablecoins move fast, cheap, and without friction.

Topics Covered:

What are Stablecoins?

Stablecoins are a special type of cryptocurrency designed to do something that most crypto can’t: stay stable.

Unlike Bitcoin or Ethereum, whose prices can swing wildly in a day, stablecoins are pegged to something steady, like the U.S. dollar. So if you hold 1 USDC (a popular stablecoin), it’s always worth about $1. That makes it reliable, predictable, and far more useful for everyday transactions.

But stablecoins aren’t just digital dollars. They’re a bridge connecting the old financial system (fiat, banks, payments) to the new decentralized web3 economy.

In the Web3 ecosystem where finance, identity, and ownership are being rebuilt from the ground up, stablecoins act as the fuel. They power:

Peer-to-peer payments

DeFi lending and borrowing

On-chain payroll

NFTs priced in dollars

Commerce apps like Solana Pay

Cross-border remittances

No central bank controls the movement. No credit card fees. No 3-day settlement delays. Just programmable dollars that work like software.

Of course, not everything is perfect. Stablecoins come with risks—from how they’re backed to how they're regulated—but the core idea is revolutionary: Take the trust and utility of fiat. Add the speed and flexibility of crypto. That’s the promise of stablecoins.

But, before diving deep into Stablecoins on Solana, lets address who first thought of Stablecoins?

Who First Thought of Stablecoins?

The idea of a price-stable digital currency wasn’t born in crypto. It’s much older and much deeper.

(1) The Theoretical Origin: “E-Money” & Digital Fiat: Economists and technologists as far back as the 1990s were floating the idea of digital cash. Thinkers like David Chaum (eCash) and Nick Szabo (bit gold) talked about digital forms of money that didn’t rely on banks but none solved the stability problem.

(2) Most credit J.R. Willett, author of the Mastercoin whitepaper (2012), with the first true written vision of stablecoins ( which was written with the original intent of providing stability to Bitcoin). Here he discusses about tokens backed by a fixed amount of real-world currency, issued and redeemed at a fixed price, providing a stable unit of account within crypto. Willett wasn’t using the word “stablecoin” yet (that came later), but he clearly envisioned asset-pegged, programmatically redeemable digital currencies inside a crypto which is the exact concept behind USDC, USDT, and the entire modern stablecoin ecosystem.

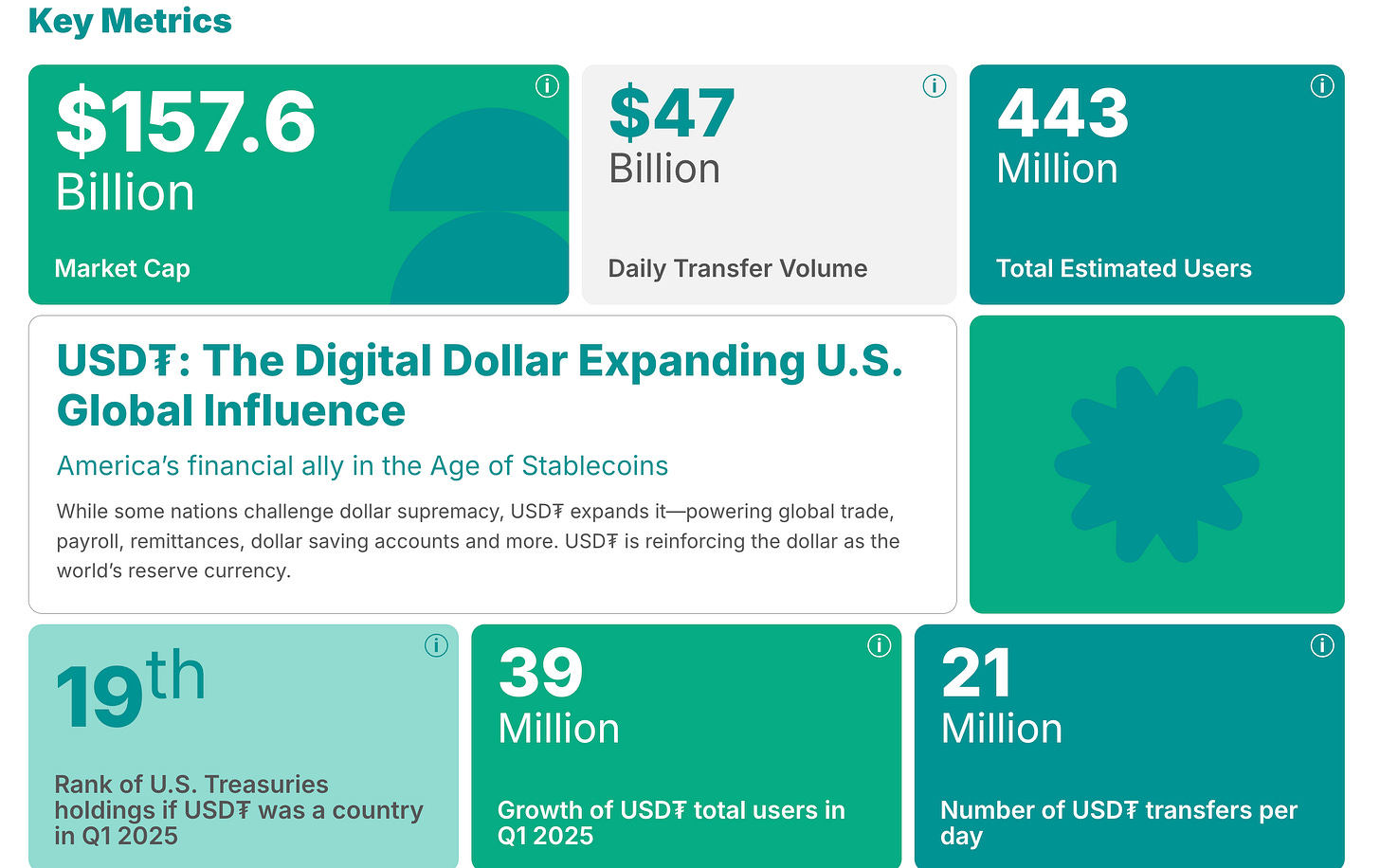

(3) Tether (2014), originally launched as Realcoin, was the first project to implement this idea. Built initially on the Omni layer atop Bitcoin, Tether started with under $1 million in market cap, but quickly found product-market fit as exchanges adopted it as a core trading pair. Its promise was clear and easy to understand: 1 USDT equals 1 USD, backed by reserves. Over time, it expanded to Ethereum, Tron, Solana, and other chains, becoming the most liquid and widely integrated stablecoin in the world. At present, USD₮ has a market cap of $157.6 Billion, $47 Billion of Daily Transfer Volume and 443 Million Total Estimated Users.

Stablecoins were once touted as the boring alternative to volatile cryptocurrencies have now carved out a powerful role in the market. But just how popular have they become and why? Let’s take a look.

Popularity of Stablecoins

As of mid-2025, the global stablecoin market cap reached around $256 billion, up from approximately $130 billion just a few months prior.

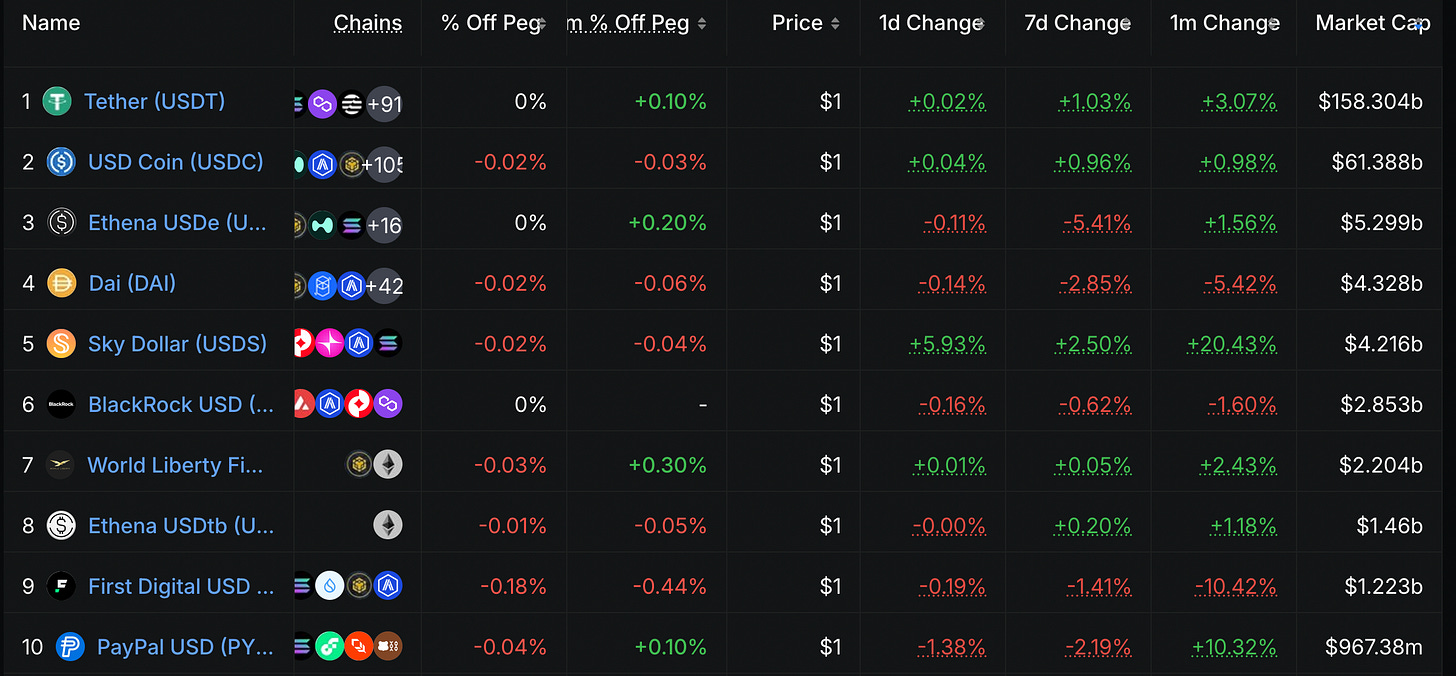

Major stablecoins include Tether (USDT) at ~$158 billion and USDC around ~$61 billion.

In 2024 alone, stablecoin transaction volume hit a record $27.6 trillion, surpassing the combined Visa & Mastercard volume.

USDT alone has over 39 million users (refer the screenshot above), with tens of thousands of new wallets interacting with stablecoins everyday that forms part of the 21 million USDT transfers per day (again, refer the screenshot above). On the institutional sides, giants like Fireblocks (with 300 banks and payments providers onboard) process 15% of global stablecoin volume (>35 million transactions every month), Visa (became the first major payments network to settle transaction in stablecoin in 2023) and Stripe are integrating stablecoins into their payment infrastructure.

Reasons behind the Popularity of Stablecoins

Stablecoins have exploded in popularity because they solve one of crypto’s biggest problems: volatility.

By maintaining a steady value which is typically pegged to fiat currencies like the US dollar they make digital money usable for real-world financial applications. The benefits are straightforward but powerful.

First, price stability makes them ideal for payments, payroll, and commerce, where predictability is essential.

Second, they offer global accessibility as anyone with an internet connection can use stablecoins, no bank account required.

Third, stablecoins allow for faster and cheaper transactions, especially compared to traditional cross-border payment systems. With stablecoins, value can move 24/7, settle in seconds, and cost a fraction of what SWIFT or card networks charge.

They also offer programmability, enabling automated financial services like lending, escrow, and subscriptions all without intermediaries.

Lastly, for users in inflation-prone economies, stablecoins act as a hedge against currency devaluation, giving people access to dollar-denominated stability in places where their local currency fails.

In short, stablecoins combine the trust of fiat with the efficiency of blockchain which is why they’ve become the default medium of exchange in Web3.

Not all stablecoins are built the same. While they all aim to maintain a stable value, the mechanism behind that stability varies, and so do the risks. Here's a breakdown of the main types:

Now that we’ve seen just how popular stablecoins have become, it’s important to recognize that not all stablecoins are built the same. While they all aim to maintain a stable value, the mechanism behind that stability varies, and so do the risks. Let’s break down the major categories of stablecoins.

Types of Stablecoins

1. Fiat-Backed Stablecoins: These are backed 1:1 by traditional currency reserves, like USD or EUR, and are held in bank accounts or short-term government securities. Every digital token issued corresponds to an equivalent unit of fiat in reserve.

Examples: USDC (Circle), USDT (Tether), BUSD (Binance USD), PYUSD (PayPal USD)

Risks: Centralization is the main concern. Users must trust that the issuer actually holds the reserves and can honour redemptions. Regulatory compliance and blacklisting are also factors.

Best suited for: Users and institutions who prioritize stability, liquidity, and fiat redemption especially in payments, trading, and treasury use cases.

2. Crypto-Collateralized Stablecoins: These stablecoins are backed by over-collateralized crypto assets (e.g., ETH, SOL), locked in smart contracts. The idea is to maintain stability with on-chain assets, often with a collateral ratio of 150% or more to offset crypto volatility.

Examples: DAI (MakerDAO), LUSD (Liquity), UXD (Solana-native)

Risks: Price volatility of the backing assets can trigger liquidations or peg instability. Still, they're more transparent, with all collateral visible on-chain.

Best suited for: DeFi users and crypto-native participants who want decentralization without relying on fiat banks or custodians.

3. Algorithmic Stablecoins: These stablecoins use smart contracts and algorithms to maintain their peg without fiat or crypto collateral. They often rely on mint-and-burn mechanics and economic incentives to expand or contract supply.

Examples: UST (Terra, failed), ESD (Empty Set Dollar), Ampleforth

Risks: These are highly experimental and prone to collapse if user confidence breaks. Without credible collateral, maintaining the peg during high volatility becomes nearly impossible.

Best suited for: No one, at least for now. These are mostly academic or speculative experiments, not suitable for critical financial functions.

4. Hybrid and Synthetic Stablecoins: These blend multiple approaches using partial fiat reserves, crypto collateral, and algorithmic elements to maintain peg and optimize capital efficiency. Synthetic stablecoins may represent a basket of assets or track real-world indices.

Examples: Frax (partially collateralized), USDe (Ethena), SigmaUSD (Ergo)

Risks: Complexity and opaqueness. The mechanics are harder to audit, and the stability mechanisms can be fragile under stress.

Best suited for: Advanced users or protocols exploring yield optimization, DeFi composability, or global FX alternatives.

5. Commodity Backed Stablecoins: These are collateralized using physical assets like precious metals, oil, and real estate, and most popularly, ofcourse if Gold.

Examples: Tether Gold (XAUT) and Paxos Gold (PAXG) are two of the most liquid gold-backed stablecoins.

Risks: These commodities are more likely to fluctuate in price (like with war, and now that every world leader is treading on thin ice with the weight of their ego, WW-3 is not impossible).

Best suited for: Investors who want exposure to gold and other assets without going through traditional financial intermediaries or those who want to store value in historically sound assets.

Choosing the right stablecoin for you? Each type of stablecoin reflects a different trust model. Fiat-backed ones rely on institutions. Crypto-collateralized ones rely on math and markets. Algorithmic and hybrid models bet on design and incentives. As a user or builder, the right choice depends on what risk you're willing to hold and what tradeoffs you're willing to accept.

One thing is clear, what started as a convenient hedge against crypto volatility has now evolved into a multi-purpose financial toolset. Lets unravel some of the many use cases of Stablecoins.

Use-cases of Stablecoins

Payments and Remittances: Since the ecosystem in which stablecoins are deployed is fast, global and low-cost, they can be used to let users send money across borders in seconds, skipping banks, wire fees, and weekend delays. For example, Chainalysis notes that sending remittances of $200 from Sub-Saharan Africa using stablecoins is 60% cheaper than using traditional fiat method.

Trading and DeFi Liquidity: Stablecoins are the base asset for most crypto markets which are used in trading pairs, yield farming, and lending protocols.

On-Chain Payroll and Treasury Management: DAOs and crypto-native teams use stablecoins for contributor payments and treasury diversification.

Commerce and Subscriptions: With predictable pricing and fast settlement, stablecoins are being used for on-chain purchases, subscriptions, and invoices.

Savings and Yield Products: In high-inflation economies, stablecoins offer a store of value. In DeFi, they unlock lending, borrowing, and yield-generation opportunities.

Escrow, Insurance, and Smart Contracts: Smart contracts using stablecoins enable milestone-based payments, automated settlements, and even insurance logic.

Financial Inclusion: Stablecoins offer access to dollar-equivalent value to anyone with a smartphone and an internet connection. They empower unbanked populations to save, transact, and access digital finance without needing a traditional bank account.

Bridging Web2 and Web3 Economies: Stablecoins can be used to make payments for the web2 commodities, such as through KAST cards.

Micropayments and Streaming Money: Because blockchains like Solana offer nearly zero transaction fees, stablecoins unlock use cases that were previously impossible: micropayments, tipping, per-second billing, and real-time streaming of income.

Government-Directed Programmable Money: Stablecoins introduce the concept of programmable money, funds that can include conditions, logic, or time-based behavior. Governments could leverage this to distribute aid or benefits that can only be spent on approved categories (e.g., groceries), or that expire after a set period to encourage fast consumption.

Stablecoin Utility Unlocked on Solana

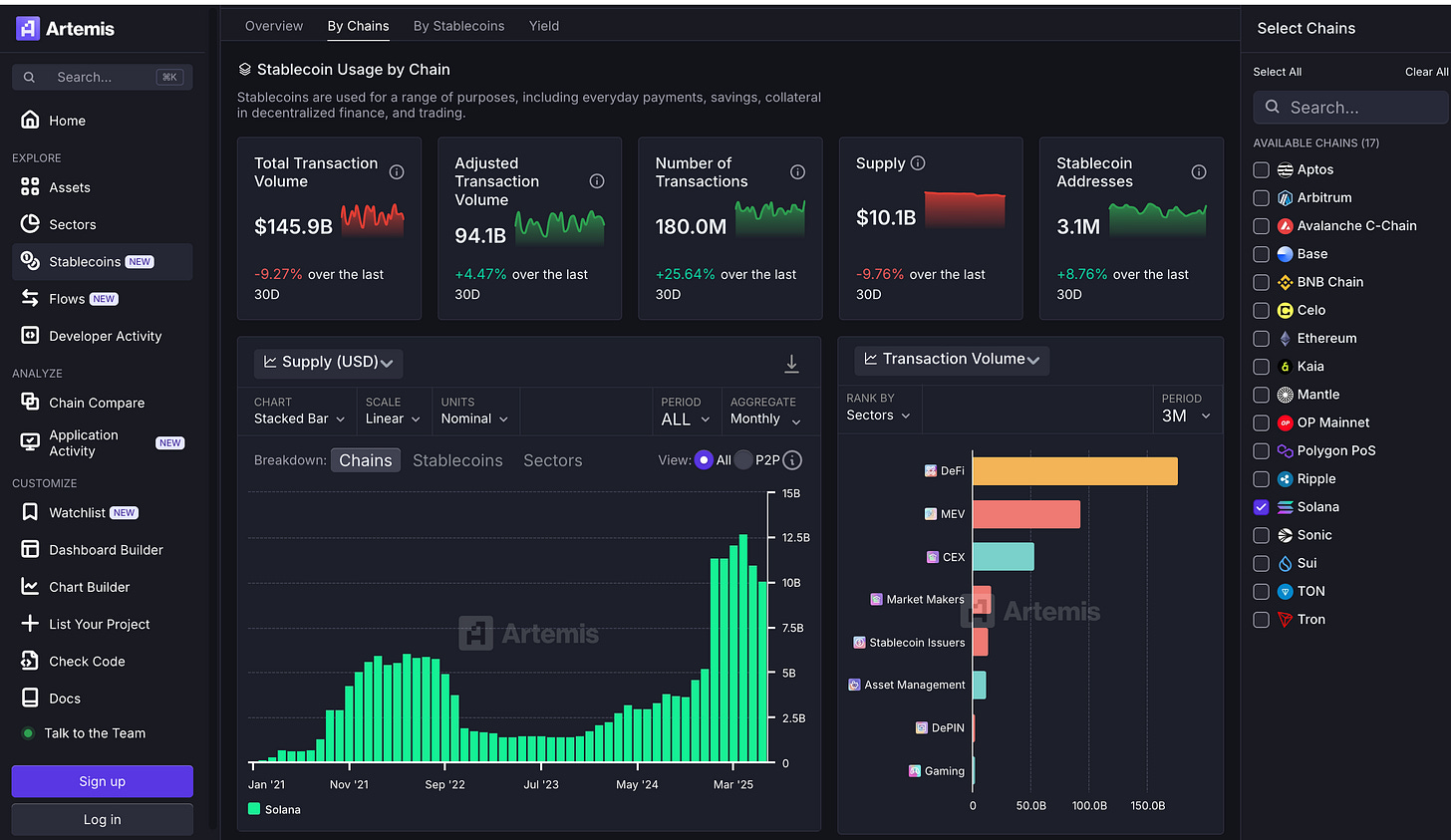

There has been a surge in adoption of Solana as a stablecoin execution layer by users, protocols, and real-world integrations (like Stripe, Shopify, and USDC’s expansion. This is reflected in the numbers. The total market cap of stablecoins on Solana surged from under $2B in mid-2024 to over $12B in early 2025. This growth aligns with the broader narrative: Solana isn't just hosting stablecoins, it's scaling them.

Further, we can observe that nearly 70% of all stablecoin value on Solana is in USDC. Note that USDC is natively issued on Solana by Circle, not bridged, improving trust, security, and compliance.

There have been about 180 million transactions in the last 30 days (+25.64% growth in a single month), it represents a surge in usage of stablecoins for DeFi, payments, and more. This also means most DeFi activity, payments, and integrations are being settled in fully transparent, fiat-backed stablecoins.

Solana stablecoins are moving over $145 billion/month significantly higher than the earlier "$40B/month" benchmark. Further, we can observe that DeFi dominates stablecoin transaction volume, followed by MEV, CEX usage, and Market Makers. It indicates that Solana’s stablecoins aren’t just payment tools but that they’re embedded in core financial infrastructure.

With over 180 million stablecoin transactions and $145 billion in volume in just 30 days, Solana isn’t just a host chain but it’s a thriving stablecoin ecosystem.

After seeing the sheer scale, one obvious question emerges:

Why is all of this happening on Solana?

The answer isn’t just low fees or fast blocks. It’s infrastructure maturity. Solana has quietly evolved into the most performant, application-ready, and compliance-capable chain in the entire ecosystem. It’s not just “fast.” It’s built for this.

According to Helius, Solana’s protocol-level advancements are unmatched:

Local Fee Markets reduce congestion and keep transaction costs predictable—even during peak usage.

QUIC-based networking and an improved transaction scheduler enhance speed, throughput, and reliability.

Timely Vote Credits (TVC) and stake-weighted Quality of Service (QoS) ensure high-priority transactions (like payments) are always processed smoothly.

The development of Firedancer—a new validator client by Jump Crypto will eventually boost network throughput by 10x, further future-proofing Solana’s capacity.

And perhaps most critically, Solana continues to increase blockspace solving the scale problem that limits most L1s.

Beyond the core protocol, Solana has also introduced token extensions, an institutional-grade standard that unlocks stablecoin use cases most chains can’t support:

Confidential balances for consumer privacy and regulatory visibility

Transfer hooks that trigger programmable actions like compliance checks or embedded fees

Permanent delegate roles that allow for enforcement actions like freezes or redemptions

Further, the hype of the year is Solana launching its own phone, the Seeker, with the intent of moving to a native OS and embedding wallets, key management, and dApp access at the system level, which removes entire layers of friction and challenges the duopoly of Apple and Google. Note, that the phone is available for pre-order now. The phone will ensure that the users get stablecoin wallet by default. The inbuilt finger print seed vault makes self-custody of USDC safe and simple as a banking app. The Seeker also integrates a native dApp Store, giving users instant access to stablecoin-powered apps like Jupiter, Orca, and Solana Pay, so there is no installation hurdles

StableCoins Available on the Solana Network

Another question that might pop into your mind while reading is,

Like meme-coin can you jump into the wagon and drop your own stable coin?

It’s a tempting thought: if stablecoins are just tokens pegged to a dollar, can anyone spin one up like they do with meme-coins?

Technically, yes. Practically, not even close.

While the crypto tools to create a token are open-source and accessible, launching a stablecoin that actually works- legally, operationally, and economically is an entirely different game. Meme-coins thrive on hype. Stablecoins require liquidity, collateral, trust, audits, compliance, and increasingly, government oversight.

Why? Because unlike meme-coins, stablecoins interact directly with real-world value. If a stablecoin claims to be backed 1:1 by USD and people actually use it, it becomes a shadow bank. And regulators don’t like unlicensed banks.

That’s why we’re now seeing real laws emerge like the GENIUS Act in the U.S. and MiCA in Europe that create clear frameworks for who can issue fiat-backed stablecoins and under what rules.

This leads us to the next big question: How are governments reacting to the rise of stablecoins and who will be allowed to issue them in the future?

Risks & Operational Challenges

Even in Solana’s high-performance environment, stablecoins face meaningful risks from on-chain exploits to regulatory constraints. Understanding these challenges is vital for anyone building or holding on-chain dollars.

1. Technical & Security Vulnerabilities

Smart contract exploits remain a persistent threat.

Oracles and price feeds can be manipulated, which risks de-pegging mechanisms in only partial collateral models.

2. Chain Reliability & Throughput Constraints

Despite Solana’s impressive throughput, it has faced several outages and congestion events. These can delay tx finality and stall mission-critical flows particularly impactful when stablecoin transactions are used to settle real-time obligations.

Failed transactions and spamming remain issues.

3. Cross-Chain Interoperability Risks

Bridges like Wormhole, while powerful, introduce counterparty and smart contract risk when moving stablecoins between chains.

Not all bridges adhere to robust security standards, increasing the likelihood of theft, bugs, or mispriced redemptions.

4. Peg Risk and Reserve Opacity

Even fiat-backed stablecoins can depeg if their issuance or reserves are mismanaged. Historical collapses like TerraUSD illustrate that even on-chain confidence can be quickly undermined.

Centralized issuers occasionally face scrutiny or delays in redemptions. As cross-chain pegged assets scale, transparency into reserves and audit processes will be critical.

5. Regulatory and Compliance Hazards

Global regulators like the BIS have warned stablecoins could threaten monetary sovereignty and financial stability if left unchecked.

In the U.S., GENIUS and STABLE Acts are imposing AML and reserve transparency rules. Issuers, custodians, and wallets will need robust compliance infrastructure or face legal scrutiny.

Regulatory Outlook & Compliance Readiness

Stablecoins are financial instruments subject to real-world regulations. Here’s how the regulatory landscape is evolving across major jurisdictions:

United States: The GENIUS Act

In June 2025, the U.S. Senate passed the GENIUS Act (S.394) by a 68–30 margin. This represents the first tailored federal framework for “payment stablecoins”, mandating:

Issuers must be licensed “permitted payment stablecoin issuers” (including banks or approved nonbanks).

Tokens must be backed 1:1 with reserves held in USD or U.S. Treasuries.

Significant transparency obligations: monthly reserve proof, annual audits for issuers over $50 billion, and AML/BSA compliance.

Law enforcement tools such as “Permanent delegate” powers (token freezing/burning) align perfectly with Solana’s token extensions.

Why it matters for Solana:

Solana’s Token Extensions, like Permanent Delegate and Confidential Balances, align exactly with GENIUS-required compliance features. This positions Solana as an ecosystem ready to support regulation-compliant stablecoin issuance and usage.

European Union: MiCA Regulation

Since June 2024, the EU has implemented MiCA (Markets in Crypto-assets Regulation) covering.e-money tokens (EMTs) and asset-referenced tokens (ARTs). Key requirements include:

Prior licensing and local white-paper approval for issuers targeting EU markets.

Strict reserve and risk-mitigation standards plus capital own-fund requirements.

Limits on ARTs issuance volume and obligations for comprehensive governance, transparency, and custody.

Why it matters for Solana:

Solana is MiCA-compliant ready in design with token metadata flexibility, on-chain identity support, and privacy toolkits like Confidential Balances making EU market entry efficient and secure.

Asia & Emerging Markets

Regimes like Singapore (PSA), Hong Kong, and Japan are rapidly formalizing frameworks for digital token issuance and licensing—including fiat-backed stablecoins. These markets emphasize:

Trustable custody

AML/KYC standards

Compliance with global financial regulations

Solana’s modular and extensible architecture supports deployment in permissioned, compliant AppChains, making it a natural fit for region-specific stablecoin rails.

What This Means for Builders & Users

(A) Not All Stablecoins Are Covered

Current U.S. bills like the GENIUS Act and STABLE Act focus narrowly on “payment stablecoins” fiat-backed tokens pegged 1:1 and redeemable on demand. But they exclude major other types, including:

Algorithmic stablecoins (e.g., TerraUSD, UXD): These are explicitly outside the definition.

Yield-bearing or interest-paying stablecoins: Not considered “payment stablecoins,” they fall outside the licensing and reserve rules .

Why this matters: As regulation stands, major innovation areas like capital-efficient crypto-backed models or yield-native stablecoins remain legally unregulated, creating uncertainty and potential gaps for builders and users.

(B) Yields Cannot Be Given

Both the House and Senate versions ban paying interest or yield to stablecoin holders if it’s tied solely to holding the token.

The STABLE Act includes explicit language prohibiting yield on stablecoins.

The GENIUS Act, as finalized in the Senate, similarly bars interest payments or yield distribution by issuers.

What this means:

Builders can’t design yield-bearing stablecoins without running afoul of federal law.

It limits innovation in programmable finance, especially for DeFi-native yield models.

In turn, traditional bank deposit tokens may gain an advantage, potentially shifting stablecoin economics toward centralized players

Conclusion

So, if you are underestimating and neglecting knowing about Stablecoins with the mindset I am not in crypto, I do not need to know, you are wrong. Here's how to think of them and why they matter to anyone with an internet connection.

Stablecoins = Bridge from Web2 → Web3, They deliver crypto-native efficiency instant, low-cost, programmable money within familiar payment flows like payroll, remittances, wallets, and e-commerce. This is not a replacement for Web2—it’s a supercharged extension. Modern platforms (Stripe, Shopify, PayPal) already support stablecoins, helping to integrate blockchain into daily life seamlessly.

Why Non-Crypto Folks Should Pay Attention. Stablecoins are already bigger than Visa and Mastercard in transaction volume, $27.6 trillion in 2024, with market cap poised to nearly double to $500 billion by end of 2026.

Retail giants like Amazon and Walmart are exploring their own tokens- this isn’t fringe anymore, it’s mainstream innovation.

Emerging fintech and banks are deploying stablecoins for real-time settlement, payroll, and remittances, a strong signal: this is happening now, not someday.

Stablecoins have evolved from whispered ‘boring rails’ to the foundation of a next-generation financial ecosystem. They’ve become indispensable: stable, global, programmable money that moves at the speed of software.

Throughout this post, we’ve seen how Solana isn’t just a contender it’s the execution platform for this revolution. With over $10B in supply, $145B in monthly volume, millions of users, and protocol-level features designed for scale, compliance, and low-friction UX, Solana delivers where others can’t.

Adding to that, hardware initiatives like the Seeker phone and advanced infrastructure details from confidential balances to permanent delegates signal a chain moving from “promising” to production-ready. Regulatory momentum, too, is rising: stablecoin frameworks like the GENIUS Act and MiCA together point toward a future where on-chain dollars aren’t just legal they’re standard.

But this is just the starting line.

Builders: You now have a global, programmable dollar that can reach everyone with a smartphone.

Institutions: You have a compliance-ready, high-speed payment rail.

Users: You have a choice fast, reliable, and tangible access to real-world money, without waiting on banks.

The question now isn’t if stablecoins will power mainstream finance. The question is who will build the rails and you’re reading this because you already know the answer.

So here’s your move:

Experiment with programmable stablecoin use cases from escrow to streaming payments.

Build compliant tools that leverage Solana’s token capabilities for global regulation.

Engage with partners brands, merchants, fintechswho want to onboard millions of users without legacy friction.

We’ve spent several thousand words mapping the territory. Now it’s your turn: step into it, design the money layer you’ve always wanted, and let Solana's chain carry the stablecoin future you believe in.